lhdn tenancy agreement stamp duty

I am sharing with you few quick guides for this changed. Expenses on rental renewal including the stamp duty.

Hartanahniaga2u Tenancy Agreement Draft And Online Stamp Duty Service New Stamps System We Are Registered Company With Lhdn Trusted Tenancy Agreement E Stamping Services In Malaysia Frustrated When Line

The government has exempted stamp duty fees on transfer instruments and housing loan agreements for first residential properties worth up to RM500000 for sales and purchase agreements executed between January 1 2021 to December 31 2025.

. Rather than a single fixed fee stamp duty for tenancy agreements are calculated based on every RM250 of the annual rental. The existing customer the move-out customer shall be contacted by TNB to confirm hisher agreement to close hisher electricity account. Property service charges maintenance fees sinking fund and Indah Water bills.

The Certificate of Residence COR is issued to confirm the residence status of the taxpayer enabling them to claim tax benefit under the DTA and to avoid. Make payment for Processing fee RM3 for LV RM80 for MVHV Stamp Duty RM10 and Security Deposit depends on the premise category. Montly tax deduction MTD.

Also read all about income tax provisions for TDS on rent. Rental deduction for at least 30 stamped tenancy agreement confirmation for rental discount is needed. Normally there are two copies of the tenancy agreement one copy for the landlord and another one for the tenantBoth of the copies have to be stamped by LHDN before the process of moving into a new property occurs.

Check out last years tax rebates here. Valid period. However it is not fully Online at this point of time due to payment still requires to be done at the counter.

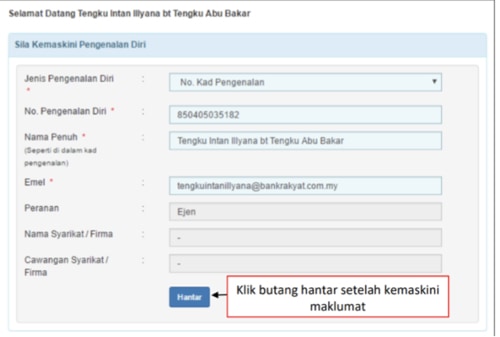

How Much Is Stamp Duty For Tenancy Agreement In 20202021. Procedure on How to Stamp your Tenancy Agreement Online. Amendments To The Stamps Act 1949.

Expenses on pest control. List of income tax relief for LHDN e-Filing 2021 YA 2020. Processing fee of RM300.

Agreement between Seller. Proof of occupancy non-owneroccupier. Participant may submit a copy of the sales and purchase agreement SPA without the receipt of a home payment provided that the SPA is validated Certified True Copy by the relevant authorities.

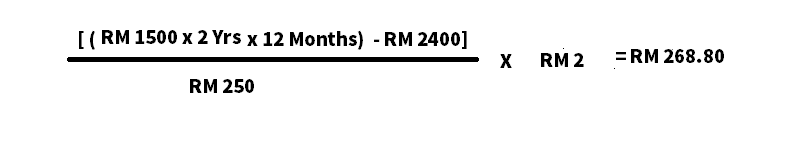

1-year tenancy agreement RM1 for every RM250 of the annual rental above RM2400. Expenses on replacement costs of furnishings. Signature of both parties.

Stamp duty is payable under Section 3 of the Indian Stamp Act 1899. Stamp duty is the governments charge levied on different property transactions. Please return the softcopy a full set of agreement together with Resit Rasmi Setem to HRD Corp by link email provided.

Tax saving in buying company vehicle. The stamp duty for a tenancy agreement in Malaysia is calculated as the following. According to LHDN taxpayers should keep their supporting documents for at least 7 years as LHDN reserves the.

RM24000 RM2400 RM21600 RM21600250 X RM1 RM864 in Stamp Duty Experts say that it is advisable to ask the staff at LHDN to stamp the respective original copies of the tenancy contract for the landlord and tenant as well as property agent if one brokered the rental deal. Termination of Account FormLetter of consent from existing account holder. Participant is allowed to request partial withdraw of Residential Properties ONLY.

With the Technology Advanced and Internet of Things LHDN stamping also move to online. One copy of your Sales Purchase Agreement or Tenancy Agreement or any proof occupancy Deposit. Stamp duty on rental agreements.

According to LHDN taxpayers should keep their supporting documents for at least 7 years as LHDN reserves the. The stamp duty is free if the annual rental is below RM2400. Proclamation of Sale Complete pages In the absence of any of these 3 documents applicant must make an application as non-owneroccupier.

Legal expenses on renewal of tenancy agreement recovery of rental arrears etc. Expenses on replacement costs of furnishings. Expenses on pest control.

Property service charges maintenance fees sinking fund and Indah Water bills. The stamp duty for a tenancy agreement is payable by the tenant whereas the copy is payable by the landlord. Expenses on rental renewal including the stamp duty.

Legal expenses on renewal of tenancy agreement recovery of rental arrears etc. Montly tax deduction MTD. Relief From Stamp Duty.

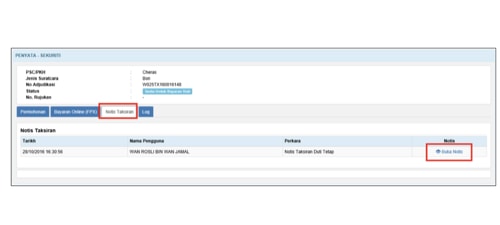

Stamp Duty RM10 to be paid at our Kedai Tenaga. Once LHDN officer approved you need to print the Resit Rasmi Setem Stamp Official Receipt and attach it into original agreement as a proof that stamp duty payment has been made and scan all together in one file. That means if the annual rental is below RM2400 the stamp duty is free.

Malaysia has an extensive network of Double Taxation Agreement DTA with treaty partners. TNB shall inform the move-in customer once the COT process is successful. For 1-year tenancy agreement.

Two months of electricity depending on the type of premises to be paid by cash or cheque. According to local rental listings site Speedrent the stamp duty for tenancy agreements in Malaysia is calculated as follows. Expenses on repairs and maintenance.

Expenses on repairs and maintenance. Stamp Duty. Rental deduction for at least 30 stamped tenancy agreement confirmation for rental discount is needed.

Stamp duty RM1 for every RM250 of the annual rental in excess of RM2400. There is a maximum period of three 3 consecutive years of. The Malaysia Inland Revenue Authority also known as Lembaga Hasil Dalam Negeri Malaysia LHDN Malaysia is where you pay your.

Stamp Duty. Tax saving in buying company vehicle. You need to pay a stamp duty when you buy a property and also when you go in for a rental agreement.

The Tenancy Agreement must be stamped by LHDN and put into effect by or after January 2018. For 2-year tenancy agreement. Duty stamp page and signature page MUST be certified.

The formula for calculating that Stamp Duty will be.

I Am Looking To Rent A Property What Do I Need To Know Beforehand Iproperty Com My

Tenancy Agreement Stamp Duty Calculator Malaysia Creatifwerks

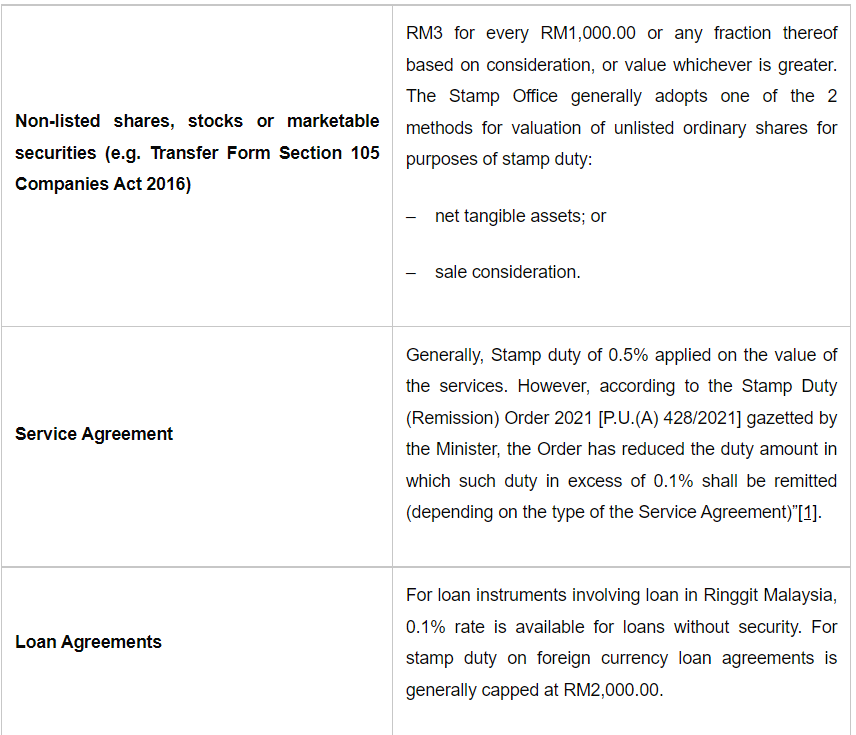

Malaysian Tax Law Stamp Duty Lexology

Stamp Lhdn Hasil Stamp Duty Exemption 2022 Mot Malaysia

What Is Tenancy Agreement 5 Secrets Behind Rental Management Success Sewanify

Detergent Tenancy Agreement Stamping Service Rental Agreement Penyeteman Perjanjian Sewa Rumah Lhdn Shopee Malaysia

Lhdn Tenancy Agreement Stamping Service Lhdn Online Stamping Penyeteman Perjanjian Sewa Perjanjian Sekuriti Perjanjian Am 合同 合约 印花税 Verified Jobs Full Time Customer Service On Carousell

Stamping Of Tenancy Agreement Semionline Property Malaysia

Tenancy Agreement In Malaysia Complete Guide And Sample Download

Rental Stamp Duty Tenancy Agreement Runner Service Property Others On Carousell

Stamp Duty Administration And Legal Fees For A Tenancy Agreement In Malaysia Iproperty Com My

Stamp Lhdn Hasil Stamp Duty Exemption 2022 Mot Malaysia

Why Should I Stamp My Tenancy Agreement Speedhome

Stamp Lhdn Hasil Stamp Duty Exemption 2022 Mot Malaysia

Stamp Duty And Administration Fee 2 Important Aspects For Tenancy Agreement In Malaysia

Online Stamping In Malaysia Youtube

How Much Is Stamp Duty For Tenancy Agreement Youtube Seremban Property Youtube

Tenancy Agreement Lhdn Stamping For Property Rental Door To Door Service Property Others On Carousell

0 Response to "lhdn tenancy agreement stamp duty"

Post a Comment